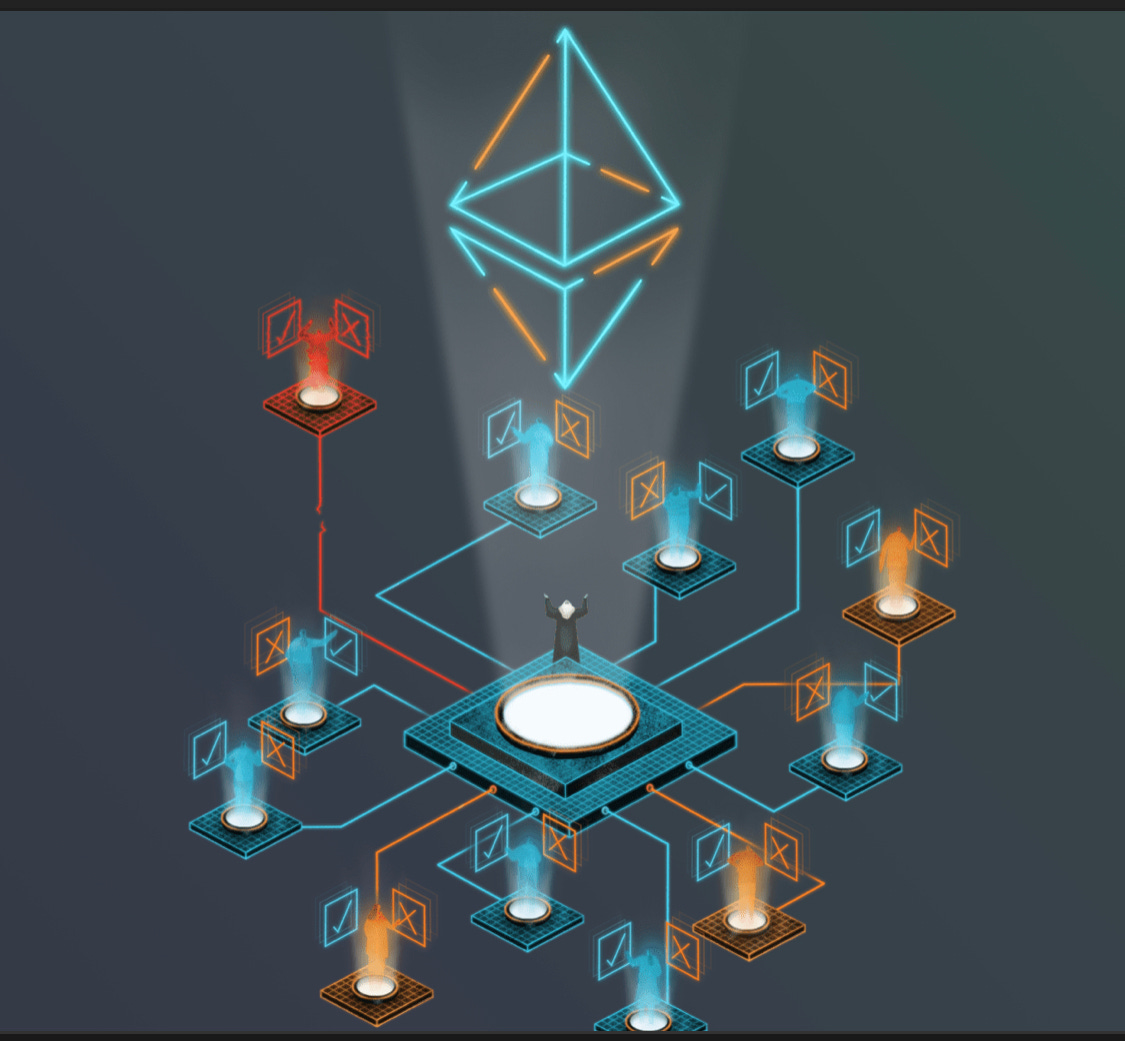

Context: Decentralized autonomous organisations (DAOs) are built by users on the blockchain. My goal with this post is to get an understanding of that idea. Smart Contracts are a fundamental piece of DAOs which I will explore in a later post.

(Image credit: Ethereum.org)

A community of crypto nerds, people who were swept in by the hype and investors, have recently tried and failed to buy a copy of the U.S. Constitution. You can read the aftermath and the chaos that ensued here.

Humans, when they were nomads for thousands of years or after they settled down as agrarian communities, had a purpose to live in groups. They lived in communities for either practising agriculture and/or hunting/gathering.

With internet, we have seen communities setup as Facebook groups, Reddit communities etc. These online communities have some centralised arbiter who determines the rules. There are usually no monetary benefits that accrue for the work done by a member and neither are any governance rights to set the rules.

The central idea of a Decentralized Autonomous Organization (DAO) is to form a decentralized community of users on a blockchain, to work on a common goal.

As it suggests in the name, DAOs are decentralized, autonomous (executable code), not controlled by any entity and members come together for a common purpose. Crypto networks’ decentralisation aspects are sometimes touted as a way to counter government censorship, or because of libertarian political views.

DAOs are going through some massive growing pains. ConstitutionDAO’s recent troubles is a prime case. DAOs are seeing a rebirth after the ‘first’ DAO led to the hard forking of the Ethereum blockchain. Some hard lessons were learnt.

DAOs built on Ethereum blockchain can issue monetary and/or governance tokens (more on tokens in a later post). DAO Tokens1 are different than coins (bitcoin/ether) and need not have value but they can provide governance rights. These rights can be transferred to another member who is deemed more knowledgeable. Tokens are typically issued for work done for the community. More voluntary work; more tokens can be given.

The idea here is to move away from ‘buying to own’ towards ‘participating to govern’.

Rules (executable code) in the context of a DAO are automatically applied and enforced when the conditions specified in the software are met. This differentiates them from traditional organizations, whose rules need to be interpreted and then applied.

Here is an example of a reasonably successful DAO.

Compound lending protocol: Compound is a DeFi (more about this in a later post) project where users can lend and borrow crypto currencies. I will not go into details on how Compound works in this post as my focus is on DAOs. All lenders and borrowers are issued COMP tokens periodically. These tokens do not have any monetary value but they give governance rights. Compound is essentially a DAO as the COMP holders will decide how it evolves.

Compound governance proposals (changes to any rules of the DAO) are executable code aka Smart contracts.

Voting period is 3 days.

If a governance change to the protocol is passed by the community, changes go into effect via code that is executed immediately.

P.S. Even if the transactions are secure on the blockchain itself, if DeFi DAOs forget about basic internet security, you might end up in situations like BadgerDAO found itself in. You cannot blame “Web 2.0” technologies for your own screw-ups!

Tokens are smart contracts based on ERC-20 specification